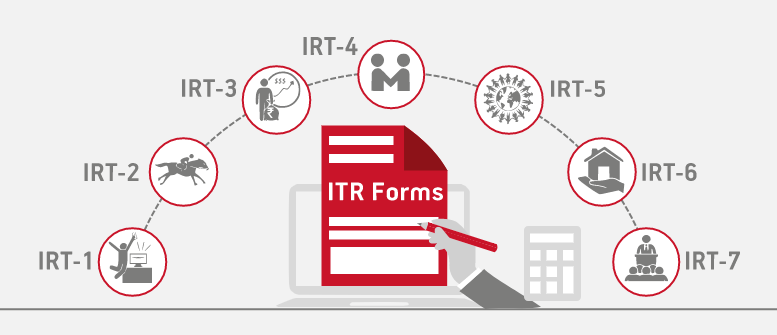

There are two main kinds of ITRs in India, the NRI (Non-Resident Indian) and the resident ITRs. A resident ITR must be filed by any resident or citizen in India who has received income from property, salary or other sources. However, there are additional forms of ITR if you have income from capital gains, if you are self-employed, or if you have any investment income, you will need to file an additional form with your ITR filing. Find out more about the different forms of ITR below and choose the right one for your specific situation.

VIT forms

The most common form of ITR is the VIT, or voluntary income tax return. This is the form that most people will use when they are employed and have their taxes withheld from their paycheck. The VIT can also be used if you are self-employed or have other sources of income.

Special IT returns (SIT)

There are different types of IT returns (SIT) in India, which vary depending on the type and size of business. The most common form is the Partnership Return, which is filed by businesses that are partners in a partnership. Other common forms include the Corporation Return, which is filed by corporations, and the Sole Proprietor Return, which is filed by sole proprietors. The type of return you file will depend on your business structure and activities.

Long term capital gains

Capital gains are profits from the sale of an asset, such as a stock, bond or real estate, where the sale price is higher than the purchase price. Long-term capital gains are gains on assets held for more than a year. In India, long-term capital gains are taxed at lower rates than short-term capital gains. For example, if you buy and sell stocks within a day or week, your profit will be taxed at the same rate as your income. But if you hold stocks for more than a year before selling them, you can pay tax at about 20% (plus surcharges). Short-term capital gains: Profit made by investing in securities and commodities that have been owned less than 12 months before they were sold. In general, short-term capital gains are taxable based on income tax brackets which depend on total taxable income.

Securities Transaction Tax (STT)

STT is a tax levied on the value of securities (shares, bonds, debentures, etc.) traded on the stock exchanges. It is paid by the buyer at the time of purchase and collected by the seller at the time of sale. The STT rate depends on the type of security traded and the value of the transaction.

For equity shares, the STT rate is 0.1% for transactions up to Rs 1 lakh and 0.025% for transactions above Rs 1 lakh.

Who should file the income tax return?

In India, every person who has an annual income of more than Rs. 2,50,000 is required to file an Income Tax Return. This includes salaried employees, self-employed individuals, and people with income from other sources such as rent, interest, dividends, etc. The due date for filing ITR is 31st July of the assessment year.

What to consider while filing your tax return?

The first thing you need to do is find out which form applies to your situation. If you’re an individual with income from a salary, pension, interest, or capital gains, then you’ll need to file a Form 1040. If you’re a business owner, then you’ll need to file a Form 1120. There are also different forms for different types of businesses, so make sure you choose the right one.

Filing Income Tax Return Online, how does it work?

If you’re a resident of India and have taxable income, you’re required to file an income tax return (ITR). This can be done online through the e-filing portal. The process is fairly simple: you’ll need to register for an account, log in, and then fill out the required forms. Once you’ve submitted your return, the Income Tax Department will process it and issue a refund (if applicable).