DEFINATION OF PRIVATE LIMITED COMPANY

The Ministry of Corporate Affairs regulates private limited companies in India (MCA). DOCS PLANNER makes it simple to register a business because everything is done online.

AS PER COMPANIES ACT 2013 SECTION 2(68) PRIVATE COMPANY MEANS:

A company having a minimum paid-up share capital as may be prescribed, and which by its articles,

- restricts the right to transfer its shares;

- except in case of One Person Company, limits the number of its members to two hundred;

- prohibits any invitation to the public to subscribe to any securities of the company.

It is highly recommended that you register a private limited company because this type of business gives shareholders limited liability and places certain constraints on ownership.

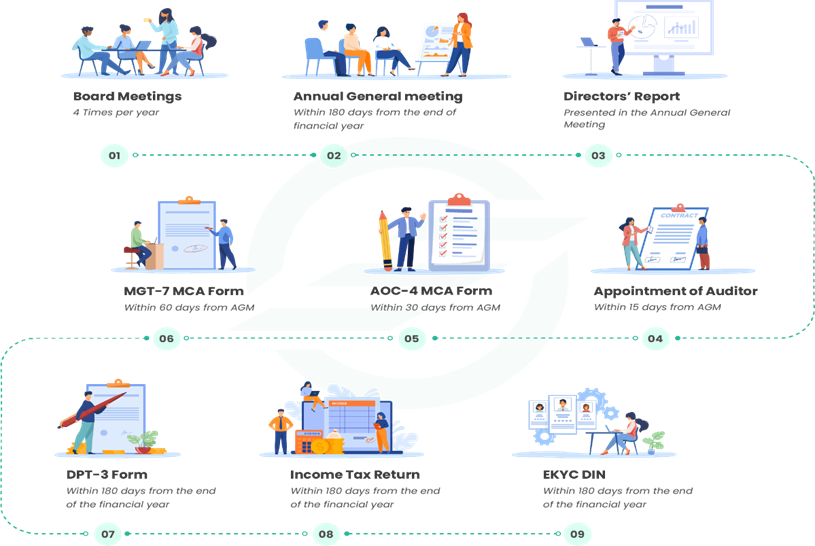

If you’ve established your firm as a private limited company, there are several annual compliance for private limited company that are mandatory for you. Being non-compliant with these rules will lead to penalties and may also bring closure to business in extreme cases.

This blog aims to simplify the business compliance process for you and provides detailed information about the Annual Compliance For Private Limited Company In India.

WHAT ARE THE KEY COMPONENTS OF ANNUAL COMPLIANCES OF A PRIVATE LIMITED COMPANY?

ROC is also known as Registrar of Companies under the Ministry of Corporate Affairs looks after the compliances of Companies under its jurisdiction. Every Pvt. Ltd. company irrespective of its size has to file returns and documents to comply with the legal requirements given in the Act and is known as ROC compliances.

Failing to comply with rules & guidelines can attract a hefty penalty on the company and their stakeholders

So, Let’s get insights on what are the key components of annual compliances

1.SCHEDULING BOARD MEETINGS

As Per Section 173 of Company Act 2013 & Secretarial Standard – I, Every Company shall hold a minimum number of FOUR meetings of its Board of Directors every year in such a manner that maximum gap between two meeting should not be more than 120 (One hundred twenty) days. The company should hold at least 1 (one) Board Meeting every quarter of the calendar year.

2.Filing of ADT-1

As per Section 139 of Company Act 2013, Every company needs to appoint of Auditor will be appointed for the 5 (Five) years and form ADT-1 will be filed for a 5-years appointment.

After that, every year in AGM shareholder will ratify the Auditor but there is no need to file ADT-1.

3.Filing of DIR- 8

As per Section 164(2) of Company’s Act 2013 Every Director of the Company in each Financial Year will file with the Company disclosure and non-disqualification.

4.Filing Of Inc-20A

As per the Companies (Amendment) Ordinance 2018, there is a requirement for all the companies registered on or after 2nd November 2018 to file a declaration of commencement of business. Form INC-20A was introduced to fulfil that requirement. It needs to be filed by the directors/owners with the ROC. It has to be verified by the practicing Chartered Accountant (CA), Company Secretary (CS), or Cost Management Accountant (CMA).

5.Filing of MBP-1

As per Section 184(1) of Company’s Act 2013 Every Director of the Company in First Meeting of the Board of Director in each Financial Year will disclose his interest in other entities under (Form MBP-1)

6.Filing of MGT-7

As per Section 92 of Company Act 2013, Every Company will file its E-form also known as Annual Return within 60 days of holding MGT-7 Annual General Meeting. Annual Return will be for the period 1 st April to 31st March.

7.Filing of AOC-4

As per Section 137 of Company Act 2013, Every Company is required to file its Balance Sheet along with a statement of Profit and Loss Account and Director Report in this form.

8.Preparation & Filing of Financial Statements along with Form AOC-4

Balance Sheet, Statement of Profit & Loss Account (Including Consolidated Financial Statement), Directors’ Report, Auditors’ Report, Cash Flow Statement and Notice of AGM.

9.Preparation of Director Report

As per Section 134 of Company Act 2013, Directors’ Report will be prepared by a mention of all the information required for Small Company.

10.Circulation of Financial Statement

As per Section 136 of Company Act 2013, Company will send to the members of the Company approved Financial Statement (including consolidated Financial Statement), Cash Flow Statement, Directors’ Report and Auditors’ Report at least 21 clear days before the Annual General Meeting. (Except in case of AGM is called on Shorter Notice)

11.Scheduling of Annual General Meeting

As per Section 136 of Company Act 2013, Every Notice of Annual General Meeting will be prepared SS-II as per Section 101 of Companies Act 2013 and Secretarial Standard – II.

12.Preparation & Filing of Annual Return

As per Section 92 of Company Act 2013, Annual Return of Private Company (Except Small Company) should be signed by Company Secretary in Practice.